additional tax assessed meaning

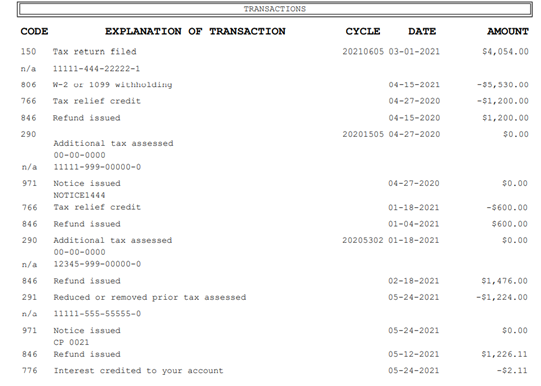

Once the decision of the Tax Court becomes final the Service has only 60 days in non-TEFRA cases in which to assess the tax plus any additional time obtained through tacking For time limitation on assessment in TEFRA cases see CCDM 359352. A month later I request a transcript and it gave me code 290 additional tax assessed on the same date I.

Irs Code 290 Solved What Does It Mean On 2021 2022 Tax Transcript

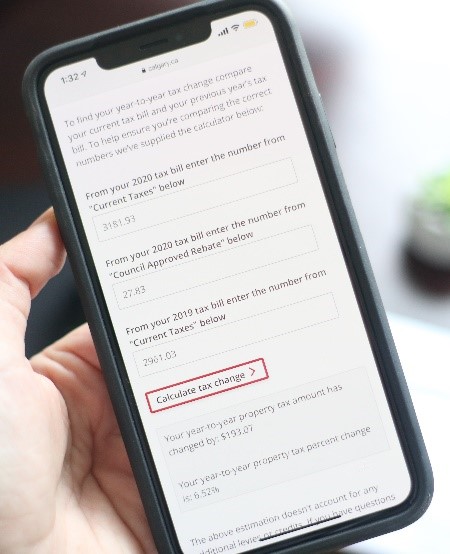

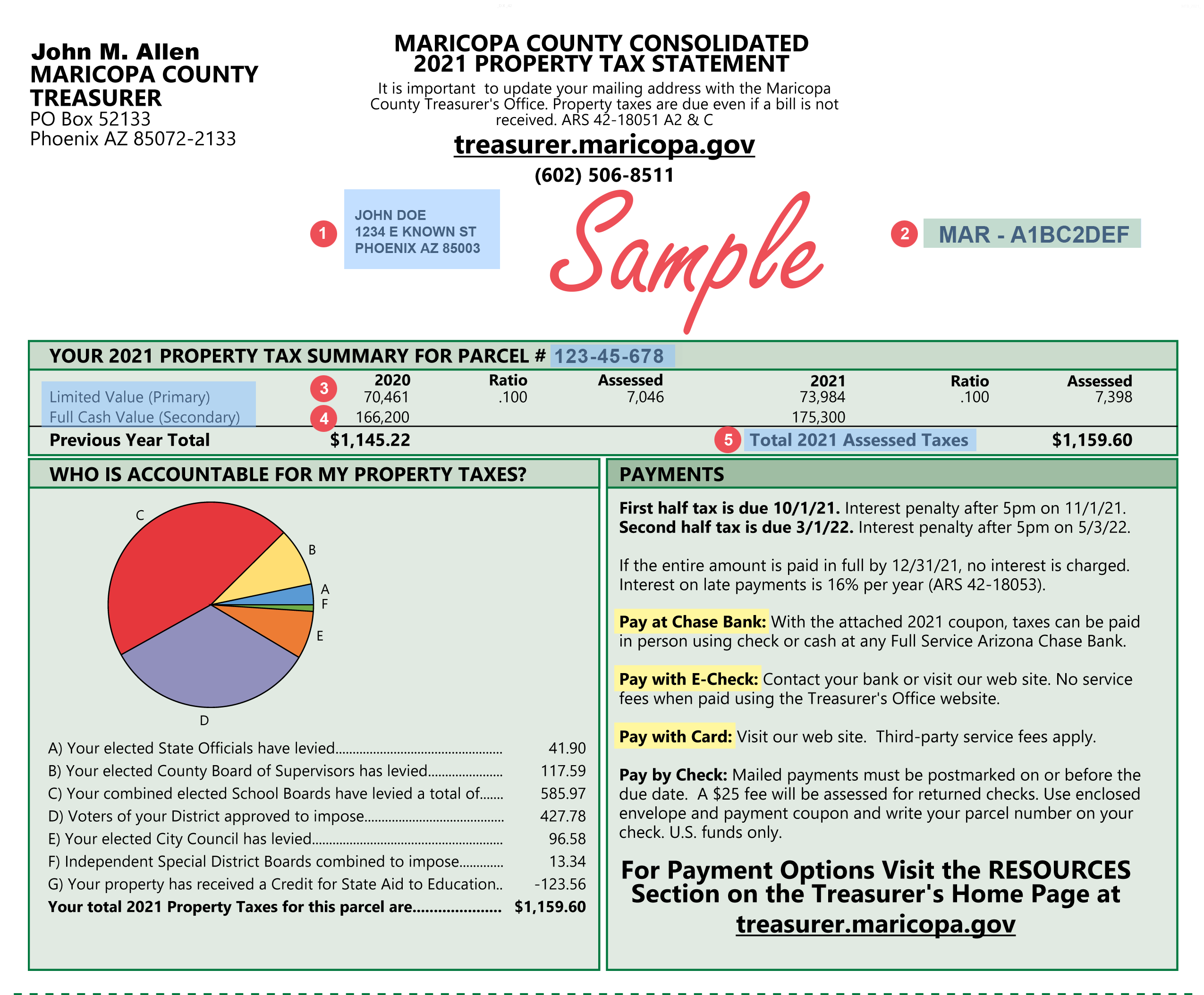

A tax assessment is a number that is assigned by the taxing authority of your state county or municipality depending on where the property is located as the value of your property.

. Additional tax assessed basically means that IRS did not agree with the original amount assessed and increased the tax you owe. It is a further assessment for a tax of the same character previously paid in part. I filed an injured spouse from and my account was adjusted.

It may mean that your Return was selected for an audit review and at least for the date shown no additional tax was assessed. You can request Wage and Income Transcripts from IRS httpwwwirsgovIndividualsGet-Transcript and compare the numbers reported to IRS. I phoned them after a couple of days because they said that I will receive a notification within 48 hours which I did not.

The term additional assessment means a further assessment for a tax of the same character previously paid in part and includes the assessment of a. The cycle code simply means that your account is updated weekly not daily. Your property tax bill is based on the assessed value of your property any exemptions for which you qualify and a property tax rate.

An additional assessment is incorporated in the definition of an assessment. I was accepted 210 and no change or following messages on Transcript since. Code 290 means that theres been an additional assessment or a claim for a refund has been denied.

Keep in mind that there are several other assessment codes depending on the type of assessment. Your property tax assessment is determined on a certain date. Approved means they are preparing to send your refund to your bank or directly to.

Yes your additional assessment could be 0. Upon looking into my account online I found that I have been charged code 290 Additional tax assessed 240. In simple terms the IRS code 290 on the tax transcript means additional tax assessed.

Self-assessment is defined in section 1 of the Act as follows. 575 rows Additional tax assessed. What is a additional assessment from SARS.

A determination of the amount of tax payable under a tax Act by a taxpayer and. The assessment is multiplied by the tax rate and that is how your annual tax bill is calculated. This usually happens when SARS disallows some of your expenses and therefore issues an Additional Assessment showing the extra tax that is due.

Just sitting in received. The IRS can assess additional tax at any time if it can prove the taxpayer filed a fraudulent return or failed to file a. In simple terms the IRS code 290 on the 2021 tax transcript means additional tax assessed.

Possibly you left income off your return that was reported to IRS. Additional assessment is a redetermination of liability for a tax. The following is an example of a case law which defines an additional assessment.

It may actually mean that your Tax Return was chosen for an audit review and for the date shown no additional tax was assessed. Additional tax as a result of an. Additional Assessment this means more tax is due If however SARS is of the view that your supporting documents do not match your tax return they may issue you an Additional Assessment.

This number is called your tax assessment. Tax Assessment means any notice demand assessment deemed assessment including a notice of adjustment of a Tax loss whether revenue or capital in nature claimed by a Brand Company in a manner adversely affecting the Brand Company amended assessment determination return or other document issued by a Tax Authority or lodged with a Tax. It may mean that your Return was selected for an audit review and at least for the date shown no additional tax was assessed.

Just noticed on my transcript additional tax assessed 000 right around the time i filled in Jan. Accessed means that the IRS is going through your tax return to make sure that everything is correct. Code 290 Additional Tax Assessed on transcript following filing in Jan.

Why was additional tax assessed. What does your 2019 tax return has been assessed mean. I did my eFiling as usualthen I got a ITA34 which said that they owe me money then they requested that I give them the supporting documents which I handed in at the SARS offices.

A Submitting a return which incorporates the determination of tax. Tax is an amount of money that you have to pay to the government so that it can pay for. Meaning pronunciation translations and examples.

I received a notice from the IRS that I owed some taxes from 2017 of which I was unaware. Code Explanation Cycle Date Amount. In simple terms the IRS code 290 on the 2021 tax transcript means additional tax assessed.

The tax code 290 Additional Tax Assessed ordinarily appears on your transcript if you have no additional tax assessment. When additional tax is assessed on an account the TC is 290. It means that your return has passed the initial screening and at least for the moment has been accepted.

What does additional tax assessed 09254-587-08904-6 mean with a cycle date 20162705.

Irs Code 290 Meaning Of Code 290 On 2021 2022 Tax Transcript Solved

Understanding California S Property Taxes

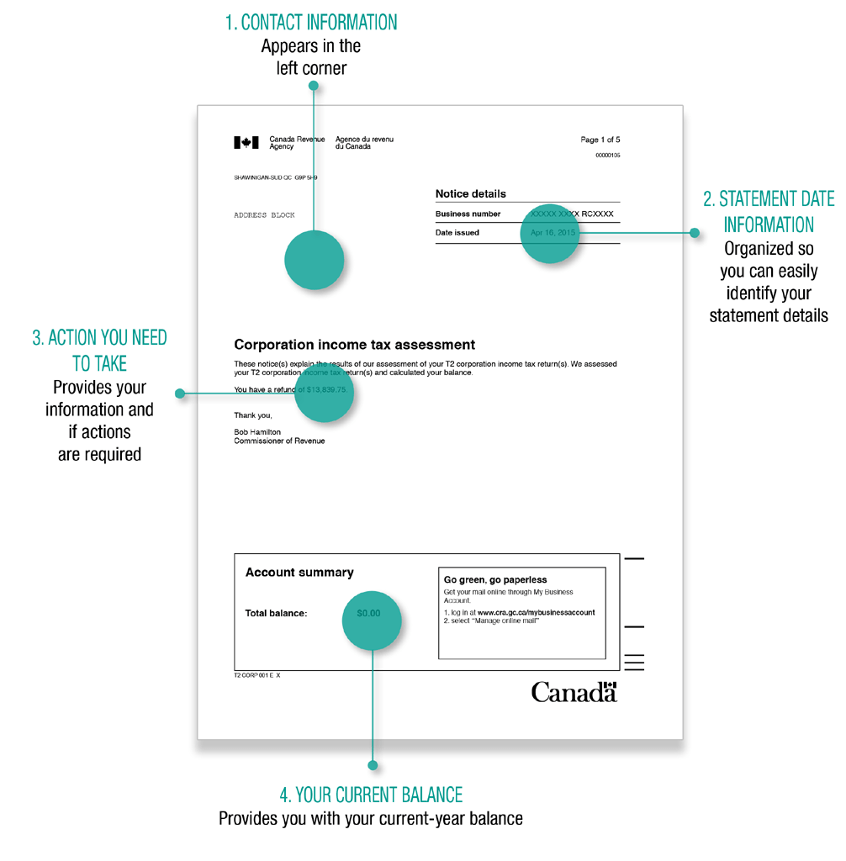

Notice Of Assessment Overview How To Get Cra Audits

/GettyImages-1042505068-d5c7b095f4704a5286a5cabcc25f4495.jpg)

Your Property Tax Assessment What Does It Mean

Ad Valorem Tax Overview And Guide Types Of Value Based Taxes

Your Property Tax Assessment What Does It Mean

Sample Rural Property Tax Notice Province Of British Columbia

![]()

Irs Code 290 Solved What Does It Mean On 2021 2022 Tax Transcript

Toronto Property Tax 2021 Calculator Rates Wowa Ca

Oshawa Property Tax 2021 Calculator Rates Wowa Ca

Cra Notice Of Assessment Why It S Needed For Separation Divorce Fyi

Understanding Your Eht Monthly Account Summary Notice Of Assessment

Cra Notice Of Assessment Why It S Needed For Separation Divorce Fyi

/u-s-tax-filing-1090495926-21c69e6cc0ba4db0894841c99b26adbf.jpg)

Notice Of Deficiency Definition

Nta Blog Decoding Irs Transcripts And The New Transcript Format Part Ii Taxpayer Advocate Service

:max_bytes(150000):strip_icc()/taxes_due-6bb60b22f93948bbb123e098ecbf5d21.jpg)